Reaching a divorce settlement can seem like the final step toward closure. Many people feel tempted to “sign and be done,” so the process can end quickly. But a settlement is a binding legal agreement, and once you sign, changing it later is extremely difficult.

Understanding how to negotiate a divorce settlement in North Carolina means knowing what rights are on the table before you agree.

A settlement affects property, debt, support, retirement, and parental responsibilities. Courts expect both sides to fully disclose finances and follow North Carolina divorce laws. You can review the NC Judicial Branch separation and divorce guidance to see how courts handle these issues.

This stage is about careful decisions, not rushed choices. Taking time to review assets, future income, and long-term needs helps prevent mistakes that cannot be undone later.

Martine Law’s family law attorneys help clients evaluate proposed divorce settlements, assess financial impact, and negotiate terms that protect their interests moving forward.

To discuss your situation, call us for a consultation. Book a confidential consultation today.

Ensure the Settlement Covers Every Major Legal Issue

A divorce settlement should resolve all remaining legal issues so there are no surprises later. Missing topics lead to future disputes, extra court time, and additional costs.

Before agreeing, you should verify that the document is comprehensive and addresses the division of marital property, spousal support, child custody, and future tax considerations.

Incomplete agreements often cause conflict after the divorce is final. A clear agreement avoids misunderstandings and helps both parties move forward with certainty.

You should confirm that the settlement addresses:

- Division of marital property and debts.

- Spousal support (alimony).

- Child custody and parenting schedules.

- Retirement accounts and pensions.

Understand What Counts as Marital vs. Separate Property

North Carolina follows equitable distribution rules, which means the court focuses on what is “fair” based on the specific circumstances of marriage. This does not always result in a perfect 50/50 split.

According to N.C.G.S. § 50-20, factors such as the length of marriage and the financial health of both parties play a significant role in how assets are divided.

Before accepting a settlement, you must distinguish between marital property, which includes assets gained during the marriage, and separate property, which includes assets owned before the marriage or received as an inheritance.

Identifying these correctly prevents you from losing assets that should have been shared under state law.

Items commonly divided include:

- Bank accounts and vehicles.

- Real estate and investment properties.

- Businesses or professional practices.

Pre-Divorce Financial Planning Matters More Than You Think

Your financial planning affects your budget, housing options, and long-term goals. A settlement should work not only today but also in five and ten years from now.

Many people focus only on immediate monthly payments and overlook the “big picture” impact of their new lifestyle, such as future living expenses and the cost of individual health insurance.

Decisions made during the settlement phase shape your earning capacity and retirement security. It is vital to consider how taxes on support or investment withdrawals will affect your bottom line.

Why Debt Division Is Just as Important as Dividing Assets

Settlements divide debt as well as property, and in many cases, debt can be more contentious than assets. It is vital to understand that a divorce decree does not automatically override a contract you signed with a bank.

If your name stays on a loan, late payments by your ex-spouse can still damage your credit even after the divorce is final. Announced by the NC Equitable Distribution.

When reviewing debts, you must determine whose name is legally attached to each credit card or loan and whether the lender will release one party from the obligation.

Often, refinancing is required to remove a spouse from a mortgage or car loan. Understanding these risks protects your financial reputation for years to come.

Consider Whether Alimony Applies in Your Case

Alimony in North Carolina is designed to provide financial stability to a spouse who may be economically dependent.

According to N.C.G.S. § 50-16.3A, the court determines the amount and duration of alimony based on several factors, including income difference, the length of the marriage, and even marital misconduct.

When negotiating, it is vital to consider whether you prefer a one-time lump-sum payment or ongoing monthly support. You must also account for the fact that accepting or waiving alimony can permanently affect your future stability.

Before signing, ensure you understand:

- Duration of support and potential end dates.

- Tax consequences (as alimony laws shifted significantly in recent years).

- Circumstances for modification, such as remarriage or cohabitation.

Child Custody and Support Terms Should Be Clear and Practical

When children are involved, settlement terms should focus on stability and predictability. Vague agreements often lead to future disputes, so it is best to be as specific as possible regarding where the children live and who makes decisions.

In addition to custody, you must establish clear child support obligations. Under N.C.G.S. § 50-13.4, child support is calculated using specific statewide guidelines to ensure the reasonable needs of the child are met.

A clear agreement helps both parents move forward with certainty regarding:

- Parenting and holiday schedules (including transportation).

- Legal custody determines decision-making authority for health and education.

- Extraordinary expenses, such as medical insurance, braces, and extracurricular fees.

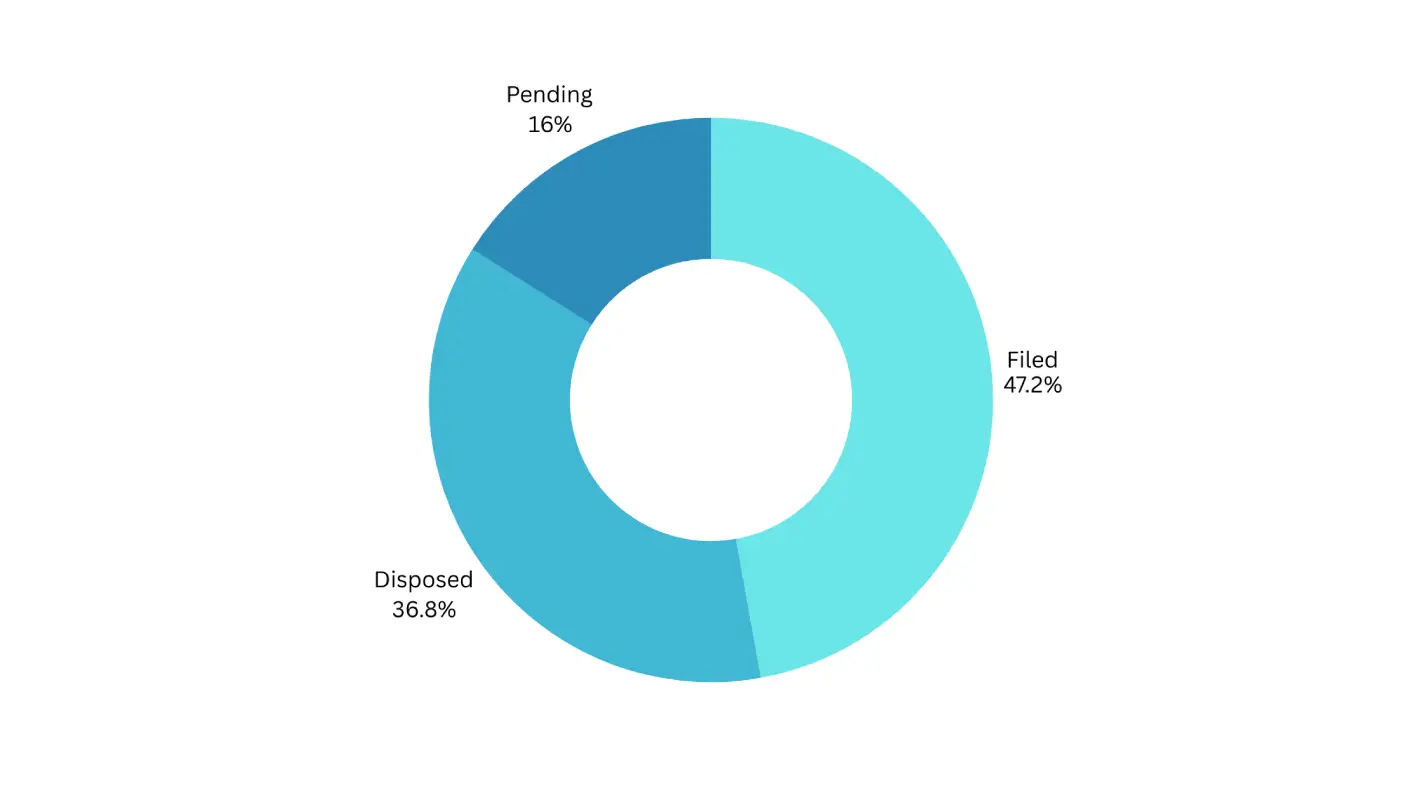

North Carolina Domestic Case Volume, Filed, Resolved, and Pending

This chart shows the number and proportion of domestic cases in North Carolina that were filed, disposed, and still pending during the reporting period. Based on available court data, approximately 45,000 cases were filed, about 35,000 cases were disposed of, and roughly 15,000 cases remained pending. The percentages in the chart reflect these approximate case counts.

Never Sign Without Full Financial Disclosure

You should never sign a settlement agreement until you have a clear and honest picture of the entire marital estate. Transparency is the only way to ensure the division is truly equitable, as discussed in NC G.S. 50-21.

This includes a review of income records, tax returns, bank statements, and retirement balances. Signing without full disclosure increases the risk of an unfair division.

Hidden assets or inaccurate information increase the risk of an unfair division. Hidden assets or inaccurate reporting can result in serious legal consequences later.

To protect yourself, ensure you have seen:

- Recent tax returns and income records.

- Business financials (if applicable).

- Appraisals for real estate and valuables.

Let’s Work Toward a Fair Divorce Settlement

A divorce settlement shapes your property, income, and financial stability for the rest of your life. Taking time to review terms carefully is an important part of protecting your future.

Understanding how to negotiate a divorce settlement means making decisions based on clarity rather than emotional pressure.

- Knowing your rights.

- Seeing the long-term financial picture.

- Making a decision based on clarity, not pressure

Martine Law’s family law attorneys help clients review proposed settlements, identify missing issues, and negotiate fair terms before signing.

For guidance about your divorce settlement or pre-divorce financial planning, call +1 (704) 842-3411 to discuss your next steps.

Frequently Asked Questions About Relationship Rules and Divorce Decisions

What is the 7-7-7 rule for couples?

The 7-7-7 rule is a relationship guideline that encourages couples to plan intentional time together on a repeating schedule. It suggests going on a date every 7 days, taking a night away every 7 weeks, and planning a longer romantic trip every 7 months. The goal is to maintain emotional connection, communication, and shared experiences instead of letting routines create distance.

Why is moving out considered the biggest mistake in a divorce?

Moving out during a divorce can create legal and financial problems. It may affect child-custody arguments, increase personal living expenses, and be viewed as abandonment of the marital home. Leaving can also weaken claims to property or household items. Because moving out has lasting consequences, most lawyers recommend getting legal advice before deciding to leave the home during a divorce.

What is the 2-2-2 rule in marriage?

The 2-2-2 rule is a relationship tip designed to keep couples connected over time. It recommends scheduling a date night every 2 weeks, a weekend getaway every 2 months, and a week-long vacation every 2 years. This structure helps couples prioritize each other, step away from daily stress, and build shared memories, which supports long-term relationship satisfaction and emotional closeness.

What is the 3-6-9 rule in a relationship?

The 3-6-9 rule describes common turning points in many relationships. Around 3 months, the honeymoon phase fades, and real habits appear. At 6 months, couples usually face deeper conversations about compatibility and conflict. Around 9 months, many people evaluate long-term potential, life goals, and commitment. The rule is a guideline, not a strict deadline, focused on reflection and communication.